Trading in the open markets is a luxury that most seasoned professionals have been able to enjoy over the past couple of decades. In the 20th century, it was unheard of for regular people to actively participate in trading. There were always people who invested their own money via financial firms. These financial firms had separate brokers assigned to various customers who would accumulate a capital from their clients and use it to trade in financial assets that were active in the markets. This is about billions of dollars worth of financial power handed to a single firm who would then go on to trade in various stock exchanges.

For decades this strategy worked as even though the financial firms were essentially acting as middlemen, the number of people trying to invest in the markets wasn’t that significant. However, as the world grew more connected, more and more people were looking to invest in financial assets but because these brokering firms didn’t have the resources to accommodate everyone, they started preferring people with more capital. This left a great number of people left to wander around as their primary point of access to the markets was cut off. These financial firms were essentially banning regular people from taking part in the free market trade which is one of the biggest signs of the markets reaching a point of saturation.

The decrease in individual investors severely hampered the markets and the need for a new trading system became prevalent. A decision was made to utilize the new technological resources of the internet to develop a new system that would accommodate all traders regardless of their financial background. This is when online trading was introduced. Online trading platforms have been around for a little over 2 decades now with a lot of the current market share of traders being held by these online traders. Online trading didn’t just accommodate everyone but it also allowed users more control over what type of asset they want to invest in and what path to take.

Trader’s Choice

It is up to the trader to select which platform suits him or her best for their needs. I remember using multiple trading platforms at one point because of the differences between their assets. When I started online trading, there weren’t many reviews as to what to look for in an online trading platform or which platform was good. I spent a good couple of weeks going through different trading platforms before I ended up with this platform for this Trader House review. Trader House was relatively new to the game as were many of the other platforms when I started trading using the online system.

I am writing this review specifically so that beginners and professionals alike understand what the actual makings of a good trading platform are. There are a lot of bogus trading platforms on the internet which are adamant about exploiting beginners. Professionals sometimes also get in the middle of these trading platforms as for many it is their first time using online trading platforms. Hopefully, this review will clear everything up.

Now there are a few basic things that are necessary for any good trading platform. These are things that essentially make up the foundation of the platform and under no circumstances can there be any sort of compromise on these features. While a lot of trading platforms differentiate from others as much as possible, there are a few features that they have in common. These are the features that convinced me to stay with this trading platform for this Trader House review because, from my perspective, they represent the basic needs of a trader’s toolkit.

- Asset management

- Secure access

- Account Diversity

- Transaction System

Asset Management

Assets are the only things that matter when it comes to conducting trade. Therefore, any tool that could assist in managing the assets requires careful calibration and implementation. There are many ways in which something as important as asset management can be incorrectly implemented.

I had a bad day when a different platform that I was suing had an asset management tool but it was so bar-metal that one might as well have ignored it in the first place. That was the day I learned that a lot of platforms say that they have these tools but in reality, their version of implementation usually isn’t up to the mark. So when I found out that I would be highlighting this feature in my Trader House review I was skeptical at first. I already had quite a few bad experiences with asset management tools in the past so I was wary of using the one available on this platform.

Alas, after mustering up the courage to use it, I was beyond surprised to see that something with such a wide range of capabilities is even available for me to use. I’ve been using the management tool ever since and haven’t had any significant issues with it yet.

Secure Access

The primary issue with traditional trading systems was that they couldn’t deal with the growing number of clients. Online trading platforms got rid of this limitation as they relied more on computer systems than regular platforms to conduct their brokering business. These online trading platforms were essentially brokers that could serve much more users at once as compared to traditional firms.

However, with such a big footprint, these platforms were more or less making themselves a mark for outside attackers looking to make a quick buck. A lot of the trading platforms I used to be registered with would constantly need to undergo a system shutdown to ensure their security. This was a broken-down version of a security system that made it inconvenient to use online trading platforms.

For this Trader House review on the other hand the platform had a robust security system that vetted all access points. This way only the real account holder could access and manipulate the account without having the system restart every time there is a threat. This active security system is what changed the game for me and a lot of my colleagues as we didn’t have to wait around for the system to reload. This way we were able to place our bids while others were still waiting for their platforms to come back online.

Account Diversity

One thing that bothered me when I was testing out new trading platforms was that a lot of them didn’t have any account options for beginners. They seemed to be targeting professionals only which made my journey a lot worse. On one hand, I had to test them to see if they were any good and on the other, they were charging a lot for something I just wanted to test. They didn’t have any demo options in place for beginners which made it even worse. When I signed up for Trader house I was blown away by the diverse number of options it offered me right out of the gate. The system was designed to service users without any hitches and the beginner accounts pushed the limit of what a good platform is capable of.

Trading using beginner accounts was a little like having training wheels. Gradually as I gained experience I was able to go at it all by myself without the training wheels and my biggest break came when I went against a seasoned professional from a different platform and came out on top.

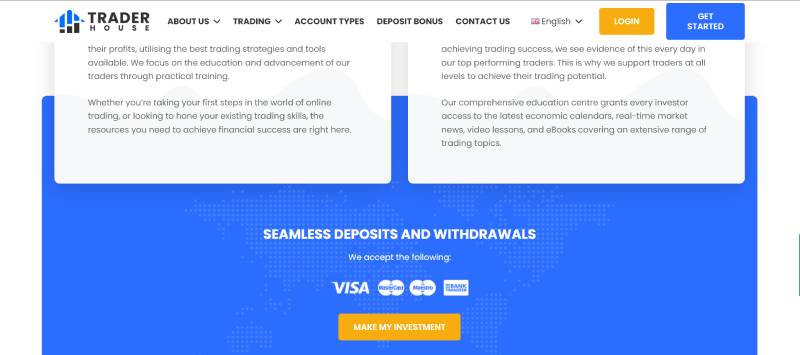

Transaction system

A trading platform is useless if users do not have access to a reliable and secure transaction system. This is such an important issue that people have suffered losses because of an unreliable transaction system.

This Trader House review shows that the platform offers a variety of options for its users who want to deposit or withdraw their money on demand. The system is secured using the platform’s state-of-the-art security system. This way users can easily manipulate their transactions without any external event affecting their investment returns. Trader House offers mainstream transaction systems that have been verified to be following the strict industry standards required for any financial transaction system. This ensures that users are not left vulnerable in case of an emergency and the extra number of options gives users the confidence that in the event one system fails, there are other options available in its place.

Platform shortcomings

Every trading platform has one or two things that could have made the experience better. In the case of this Trader House review, the platform has could use an improvement in its educational resources. Don’t get me wrong, the current resources are the reason I am where I am today but a refreshed version would be so much better.

Conclusion

There are many good trading platforms out there. While I have tried a lot of them, none of them held up as well as my choice for this Trader House review. Perhaps one day I might find a platform better than Trader House but until that day I am sticking with it because of the way it has implemented the features that make a good trading platform.

Disclaimer: This review is written from my own experience and my self-knowledge only and this is not a recommendation.