London,UK– My Brown Finance Review is not some recommendation but more of an informational review article. I am an experienced forex and cryptocurrency trader and have been in the field for like 5 years now. During my financial trading experience, I have encountered a number of trading platforms. It is because I happen to have a very strict rule when it comes to my finances, that is, “do not trust easily”. You might find it strange, but trust me, I have come up with this policy because of the very nature of the financial market.

Despite the appealing return rates in forex, stocks and cryptocurrency markets, there is a black stain on the market, which is online scams. As more people enter financial markets, the number of scammers is also increasing. Investors have been struggling to find a trusted brokerage with protected accounts. If anyone gets lucky enough to find a trusted broker, there is still a fear of getting hacked and losing all of the money. If your brokerage firm is licensed and offers security features for your account, you should feel blessed

I know this because I was scammed 3-4 times during my five years of trading experience. Sometimes brokers charge extra hidden fees, which only eat up the profit. Other times, brokers are not licensed, or your accounts get hacked. These are prevalent issues associated with the financial markets. Nevertheless, after changing many brokers, I got to use Brown Finance, and so far, it has been a pleasant experience overall.

It was recommended by my friend’s brother, an experienced trader himself. I have been using their platform for eight months now. I think it is time to write my Brown Finance Review. I would not say that it is the best platform I have ever encountered, but it was better than most platforms I had used before. Following are the pros and cons of Brown Finance based on their offered services.

Pros of Brown Finance

Here, I am mentioning the features and services of Brown Finance, which I liked the most:

- High level of Security

As I have mentioned before in my Brown Finance Review, finding a broker who offers advanced security features is challenging. According to their website, they have secured licensed from not just one but three regulatory authorities, including FCA, CySEC and CIMA. Furthermore, they require a 2-factor authentication process for registration and sign in. In this way, they provide security to our money and provide safety to our accounts from hackers. The 2-factor authentication makes it hard for hackers to access our accounts illegally. So far, I have found this platform safe and secured.

- No Surprises

One thing you would also feel worth appreciating about Brown Finance is its transparent fee structure. They do not charge any hidden fees to their clients. I have experienced many brokers before who advertise only spread fees. Still, in reality, they charge an extra price in the name of commission, withdrawal, and sometimes monthly charges. If you look at the website of Brown Finance, you will find that they have a policy of “No Surprises”. They have already mentioned every fee on their website. And the best thing is that the price is quite reasonable and competitive.

- Customer Service

Brown Finance has set up a system where they prioritize the needs of its customers. I know this because I made contact with them several times. The response of their customer service was quick and very helpful. They offer support through a mobile app, email, and phone support. Their customer service is available 24/6, which is very sensible as the company provides financial services, as most financial markets are not open on weekends. I would include their customer support in their favourable aspect because it is very responsive and quick.

- Mobile App

I cannot skip mentioning their Mobile App in my Brown Finance Review. One of the reasons that I still stick to their platform is their mobile app. Most brokers do not offer this service, which can be quite disturbing sometimes. I am an experienced trader and keep a close look at upcoming events. Occasionally, I need to enter the market to catch quick movements, which becomes very hard without a mobile app. No matter how user-friendly a broker’s platform is, it is not feasible to carry a laptop with us everywhere and every time for execution of trades. In such situations, the mobile app comes in handy and saves time & effort as well. I will put this feature into their positive side as it has enabled me to catch some profitable quick movements in the market.

- Account Types

Brown Finance can be a suitable platform for almost every type of trader. They offer three kinds of accounts based on the requirements of traders; Mini, Standard and Premium. The accounts come with different minimum deposit limits. I opened my Standard account with them for about $2500. Premium accounts can be more suited to big traders or institutional traders. Whereas they have mini accounts with lesser minimum account deposit limits for newbies. Apart from the deposit limit, account types also offer different features, including services like market brief, training sessions, and access to tools.

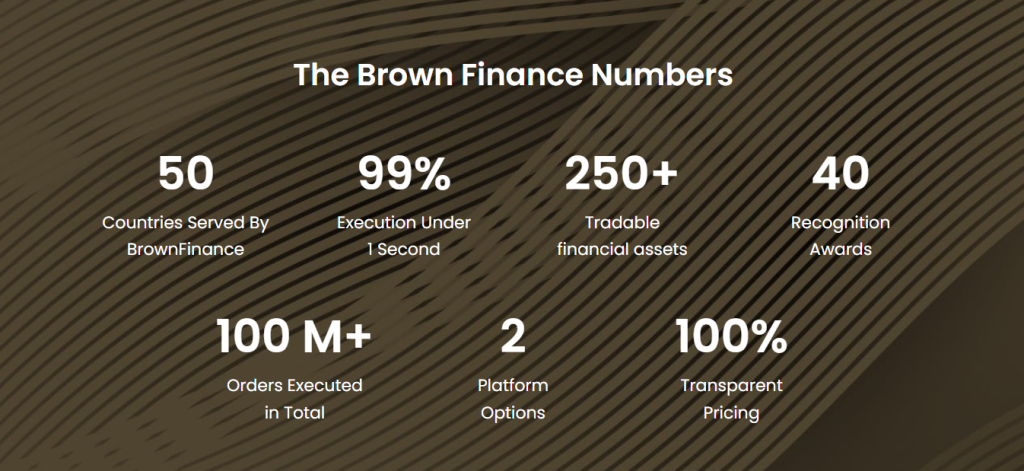

- Tradable Assets

Let me mention another feature in their favourable aspect in my Brown Finance Review: their wide range of offered tradable assets. Brown Finance has more than 250+ financial assets, including forex, cryptos, stocks, indices, etc. Many platforms provide lesser variety in their tradable assets. Some are specific for only forex, stocks or commodities and some for only cryptocurrencies. But Brown Finance delivers all kinds of financial instruments, which is very helpful. I have always found the desired asset on their platform and never missed an opportunity. All thanks to their dynamic tradable asset range.

Cons of Brown Finance

Now, I will mention some drawbacks of their platform in my Brown Finance Review.

- No News Section

I have used many broker platforms before and have developed a habit of reading financial news regularly. Most of the platforms offer news sections on their websites as well as on their mobile apps. One thing I felt missing about their services was the daily and weekly market updates. Although they have their Facebook and other social media accounts, they are not providing market updates. If only they provide such a service, I think they can increase the number of their clientage.

- Educational Resources

In my Brown Finance review, I would like to mention that their educational resources are not very competitive. I have used other broker’s platforms, which offer a high level of educational guides. Although Brown Finance provides a simple and easy learning guide, I still found it somewhat not up to the advanced level of educational guide. Most of the stuff was in written form and could be a little overwhelming for newbies. In my opinion, they can improve their educational guide by including e-books, video tutorials, and some chart examples as well.

- 1-on-1 Training

Brown Finance also lacks in providing 1-on-1 training to all of its clients. Even though I was an experienced trader, I still felt something was missing in their service, which was personal account management. They do not offer personal assistance to each client. But they offer it on-demand with extra charges. I somehow managed without training because of my past experience in trading. However, newbie traders might find it challenging to cope with the new platform and strategies. I believe broker firms should assign one personal account manager to every client and free-of-cost.

- Limited-Access to All Trading Tools

In my Brown Finance review, the last thing I want to mention is that they offer limited access to trading tools and indicators. I like to use different technical indicators and tools before entering the market. It helps me find a trade signal and generate profitable trades. However, I had limited access to technical indicators on their price charts. I think they provide access to all indicators only to their Premium account type. In my opinion, they should provide access to all technical tools for each account type.

Conclusion

I have been using Brown Finance for more than eight months now. Their fee structure, security features, and tradable assets are remarkable. According to their website, they have license from FCA, CySEC and CIMA. Their platform is very user-friendly and uncomplicated. Opening an account comes with reasonable pricing. One best thing is their Mobile app which provides quick execution of the trades. Brown Finance also offer different account types for all types of traders.

However, you might find their educational guide dull, their tools limited and market updates not efficient. While concluding my Brown Finance Review, I must say that their offered services are better than most platforms despite there is still room for improvement. If you know what you are looking for, continue reading more review articles. It is because doing your own research can help you find the right broker for your need. So far, I plan to continue using their platform until I find a better option. Good Luck on your end!

Disclaimer: This review is written from my own experience and my self-knowledge only, and this is not a recommendation.

Media Contact:

Email: [email protected]